EU Drip 4-23-2024

Antitrust,Antwerp Declaration, AI, The EU Commission's New HR Strategy, Chinese EVs and AI Investments in Europe

In this week's EU Drip, topics include Antitrust, The Antwerp Declaration, AI, the EU Commission’s new workforce strategy, and China’s EVs breaking into the European market. We also invite you to read our recent post on network analysis, i.e., those crazy spiderweb-looking things we liberally show and why they’re awesome.

Also, feel free to download my recent keynote presentation discussing how AI can be applied to public affairs.

Please get in touch with your thoughts, comments, or questions on AI and or speaking/project engagements - Chandler

Policy Trends

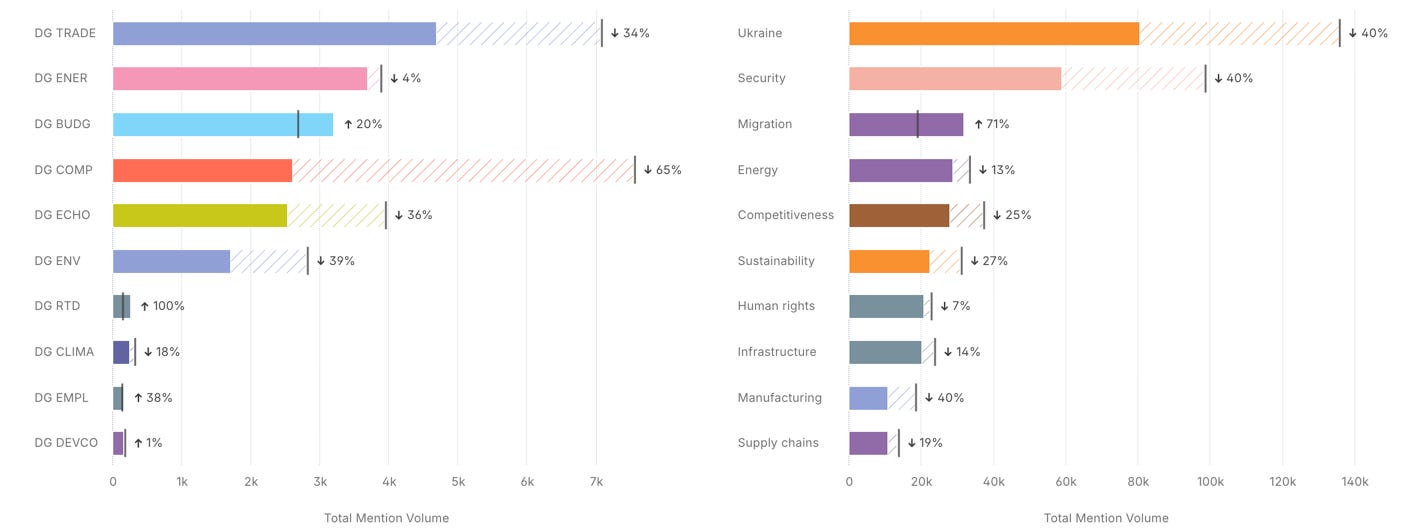

Similar to how a hedge fund analyzes stocks, we are currently monitoring and categorizing 105 policy indices. Our data analysis indicates that Ukraine has been the most commonly discussed issue/policy in the last 30 days, followed by security, migration, and energy. The top DGs mentioned were Trade, Energy, and Budget. Competition volume dropped the most, ~65% from the prior month.

Policy Themes & Directorate General Mention Volume (click to make bigger)

Antitrust

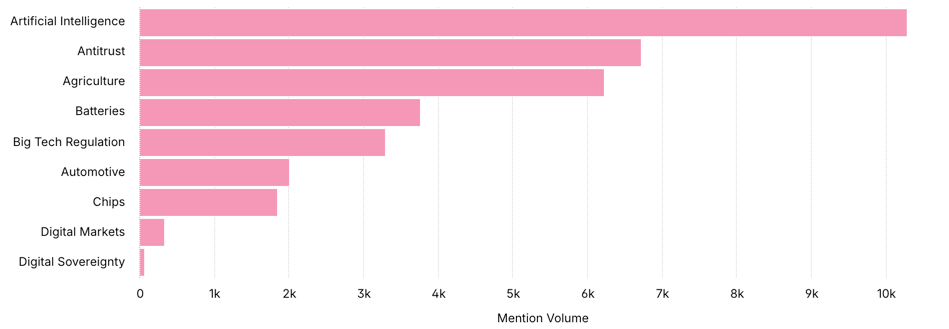

Diving into more specific policy areas, AI has had the most mentions over the last month (News, Forums, and X), followed by antitrust and agriculture. The key conversations are focused on how the European Union is taking significant steps to regulate the digital market and ensure fair competition, with a particular focus on artificial intelligence (AI). Big Tech is facing its biggest challenge in decades as antitrust regulators on both sides of the Atlantic crack down on alleged anti-competitive practices that could result in breakup orders to Apple and Alphabet’s Google, a first for the industry. Since AT&T was broken up exactly 40 years ago, no company has faced the possibility of a regulator-led breakup in the US until now.

Total Mentions of Specific Policy Areas

At the same time, the aviation industry faces competition concerns related to Lufthansa's bid to take a stake in ITA Airways. In May 2023, Lufthansa agreed to acquire a 41% stake in ITA Airways, the successor to Italy's former flag carrier Alitalia, for €325 million through a capital increase. The Italian government also committed to a €250 million capital increase into ITA as part of the deal.

In January 2024, the European Commission opened an in-depth investigation to assess the proposed acquisition, citing competition concerns on short-haul routes connecting Italy with countries in Central Europe. Lufthansa offered concessions, but the Commission deemed them insufficient. In February-March 2024, the Commission informed Lufthansa and the Italian government that it objected to the deal in its current form. The Commission is preparing a formal "statement of objections" detailing its competition concerns, pressing Lufthansa to address the identified issues.

Key concerns include:

Reduced competition on short-haul routes between Italy and Central Europe

Reduced competition on long-haul routes from Italy to the U.S., Canada, and Japan

Strengthening ITA's dominant position at Milan Linate Airport, making it harder for competitors to operate there

Lufthansa has until April 26, 2024, to propose remedies to alleviate the Commission's concerns. The airline previously offered some concessions, but the Commission deemed them insufficient. Lufthansa has said it will continue to work constructively with the Commission and remains confident the deal will ultimately be approved, believing it can strengthen competition in Europe.

Key People - Antitrust

We also used NLP to identify the individuals most linked to Antitrust and the EU domain. This indicates engagement on a global scale with regulators in both the EU and the USA, e.g., Vestager, Khan, and Warren.

Meanwhile, a report by former Italian Prime Minister Enrico Letta was welcomed by major telecoms operator Telefonica as identifying the sector as one of the strategic levers for competitiveness, innovation, citizens' well-being, and EU resilience. He noted that the significant investment required for emerging technologies like edge, cloud, 6G, and AI might necessitate consolidation within national markets or strategic alliances between market players. He also emphasized the importance of pro-competitive sharing of investments in key networks. While the Letta report and comments from other European leaders raised telecoms’ hopes for a more permissive merger regime after the EU’s mid-2024 leadership transition, Vestager has constantly warned against further market consolidation, absent evidence it would benefit consumers. In short, those working on telecom M&A will need to bring her the data on the benefits.

AI, Agriculture & Batteries

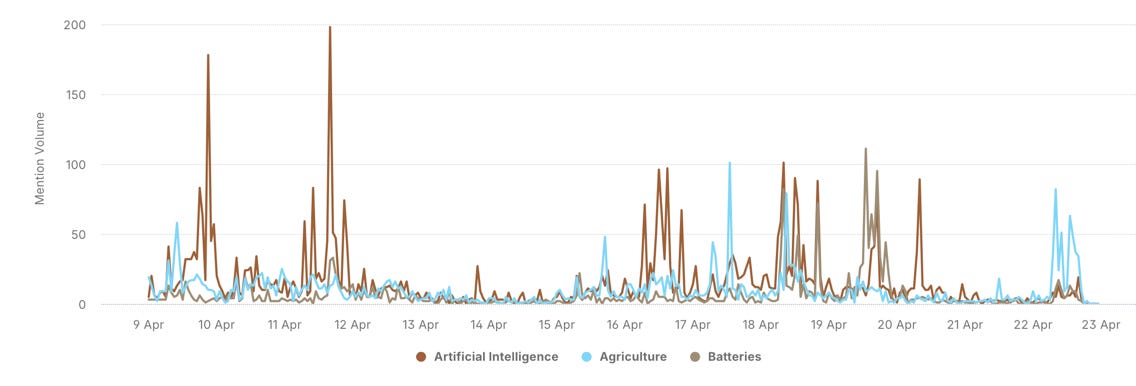

The time series graph indicates that AI, batteries, and agriculture policies have gained momentum, though not as much as in previous peaks. The conversation on AI is heavily centered on the European Union's significant steps towards regulating artificial intelligence and promoting digital innovation within its borders through the EU AI Act. The Act aims to manage the risks associated with AI technologies while encouraging innovation.

Time Series Analysis Policy Momentum

The European Commission has also introduced several digital initiatives, including image recognition systems for the healthcare sector. However, there are calls for the EU to support the creation of an artificial intelligence research institute to challenge the dominance of a few corporations in AI development.

Regarding agriculture, as the European Parliament elections approach, there is growing uncertainty about the future of climate action policies, especially those related to environmentally friendly agriculture. Meanwhile, the cocoa industry is facing challenges due to the migration of farmers from the Ivory Coast, leading regulatory bodies to take action. The agricultural sector is also struggling with the threat of the tomato leafminer pest, Tuta absoluta, which affects tomatoes and other Solanaceae plants. Farmers in Italy and Greece await approval for a new mode of action to address various agricultural challenges.

For batteries, the topics are focused on the rising demand for minerals such as copper, nickel, and rare earths, which is expected to increase sharply. Specific estimates for lithium and cobalt in the EU by 2030 are also available. To support its green transition goals, Europe aims to mine 10% of the needed minerals, recycle 25%, and process 40% of raw materials within the continent.

Policy Trends

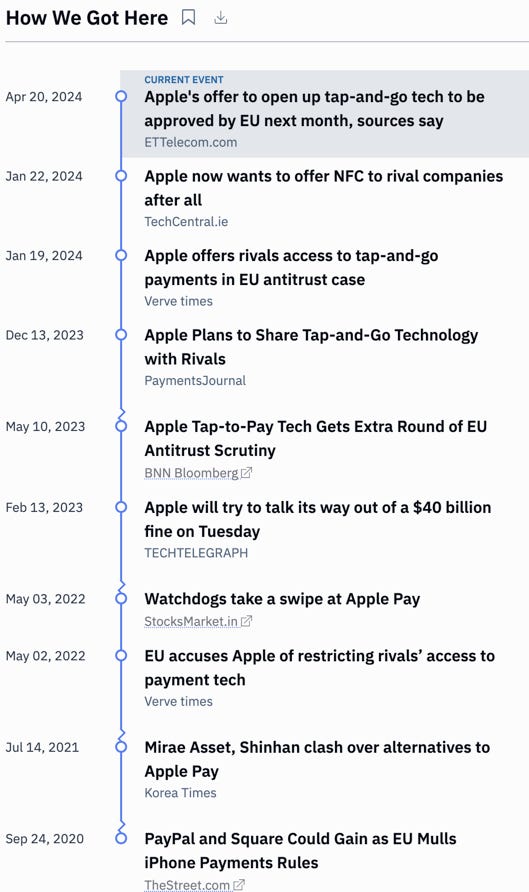

Apple's Offer To Open Up Tap-and-Go Tech to Be Approved by the EU Next Month

People familiar with the matter said Apple's offer to open its tap-and-go mobile payments system to rivals is set to be approved by EU antitrust regulators as soon as next month after it tweaked some of the terms. Apple's tap-and-go technology, called near-field communication (NFC), allows for contactless payments with mobile wallets.

Two years ago, the European Commission accused Apple of thwarting competition for its Apple Pay mobile wallet by preventing rival mobile wallet app developers from accessing its tap-and-go technology. By resolving the investigation, Apple could evade a finding of wrongdoing and a potential fine of up to 10% of its global annual turnover, according to the report. Last month, the company was hit with a 1.84 billion-euro ($2 billion) fine, its first EU antitrust penalty, for thwarting competition from Spotify and other music streaming rivals via restrictions on its App Store.

Microsoft’s $13 Billion OpenAI Deal to Avoid Formal EU Probe

Microsoft Corp.’s $13 billion investment into OpenAI Inc. is set to avoid a formal investigation by European Union merger watchdogs, calming fears that the relationship could be forced apart. The European Commission has decided that the tie-up doesn’t merit a formal probe because it falls short of a takeover and that Microsoft doesn’t control the direction of OpenAI, according to people familiar with the matter. AI outfit Anthropic has attracted a $4 billion investment from Amazon and a $2 billion investment from Google, who also forged a 2021 partnership with AI firm Cohere. For its part, Microsoft has also been actively on the lookout for more partnerships with burgeoning AI firms, earlier this year announcing a $16 million partnership with French tech firm Mistral AI. The EU said it would look at Microsoft’s investments as part of a broader examination into anticompetitive risks brought by Big Tech involvement in next-generation AI technologies.

In February, Microsoft announced a pact with Paris-based Mistral AI, which saw it make a 15-million euro ($16 million) investment in Mistral, and will make the company’s AI models available via its Azure cloud computing platform as part of the multi-year partnership.

Microsoft paid $1.5 billion for a minority stake in United Arab Emirates-based AI company G42 earlier this week, the latest in a series of multi-billion dollar investments across the AI sector in various countries around the world.

EU to Fine Mondelez Over Restricting Cross-border Trade

The EU Commission is reportedly set to fine Mondelez International for allegedly restricting the sale of its products between the bloc’s member states. The Commission intended to look into Mondelez’s involvement in restricting ‘parallel trade,’ where a company buys products in one country with a lower price and sells them in another where they are priced higher. Last February, Mondelez said the antitrust inquiry could cost the company $300m.

Antwerp Declaration

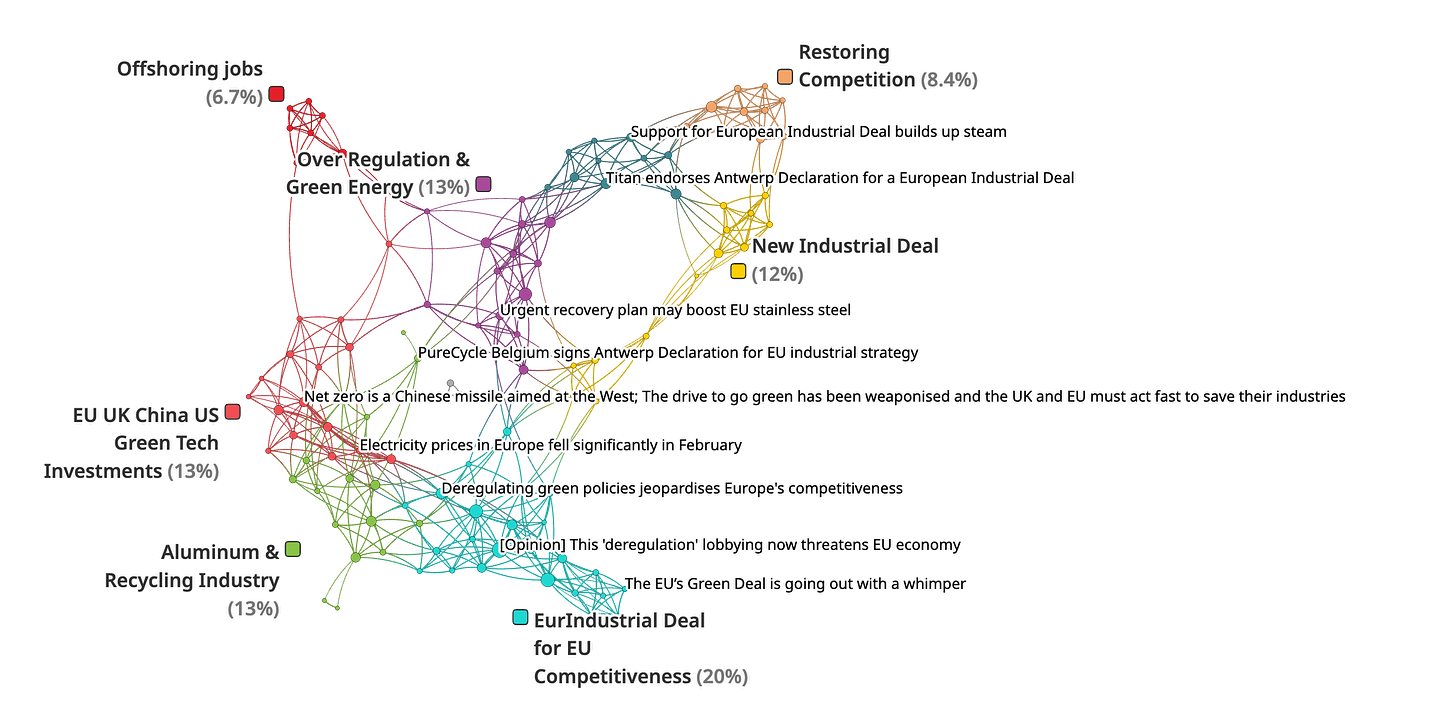

Antwerp Declaration Network. Node = News Article Size = Page Rank(Influence)

On February 20, 2024, 73 industry leaders from nearly 20 sectors presented the Antwerp Declaration to Belgian Prime Minister Alexander De Croo and European Commission President Ursula von der Leyen. The declaration underlines the industry's commitment to Europe's transformation but outlines urgent needs to make Europe competitive, resilient, and sustainable amid challenging economic conditions. It calls for integrating an EU Industrial Deal into the new European Strategic Agenda for 2024-2029 to complement the Green Deal. This includes streamlining legislation, simplifying state aid rules, ensuring raw material security, boosting demand for sustainable products, leveraging the single market, and fostering innovation.

Over 1000 companies and associations have signed a declaration, representing more than 7.8 million jobs in Europe. These signatories belong to various sectors, including chemicals, pharmaceuticals, steel, aluminum, textiles, tires, fragrances, and more. Prominent organizations such as CEFIC, BASF, and Ineos are among the signatories. Industry leaders have cautioned that Europe risks further deindustrialization, loss of competitiveness, and dependence on imports, even for basic goods, if it does not implement a targeted industrial policy.

European Commission To Revamp Hiring Strategy

With 79% of Commission staff over 40 years old, the European Commission is undertaking a significant overhaul of its hiring system aimed at attracting younger talent, addressing the challenge of an aging workforce dominated by "boomers in Brussels. This strategic shift is detailed in the Commission's latest HR strategy document, which seeks to mold the organization into a modern, flexible, and value-driven entity. The strategy is grounded in principles of cooperation, rapid recruitment processes, effective performance management, ongoing talent development, and sustainability. These measures aim to foster a more inclusive and efficient workplace.

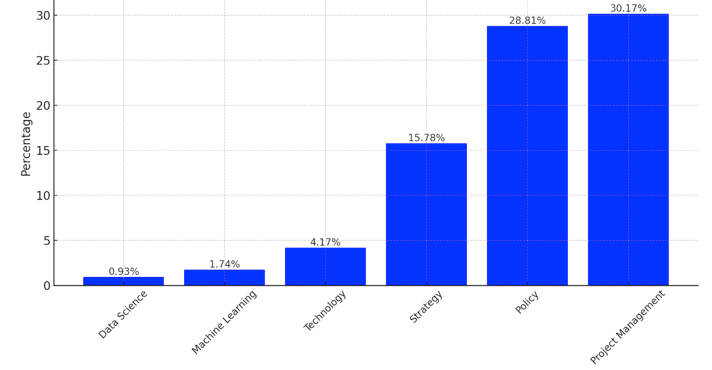

An analysis of LinkedIn data reveals that the European Commission employs 38,277 people. A breakdown of their proficiency in modern skill sets as percentages of this sample include: Data Science - 356, Machine Learning - 665, Technology - 1,596, Strategy - 6,040, Policy - 11,026, and Project Management - 11,547. It appears that most personnel skilled in AI are engaged in projects like Horizon or are contributing experts rather than full-time functionaries. Leading educational contributors to this talent pool include the College of Europe, ULB, KU Leuven, the London School of Economics, and Sciences Po.

For comparison, Goldman Sachs employs 54,855 people, with 1,806 in Data Science, 1,988 in Technology, and 2,322 in Machine Learning. The data illustrates that Goldman Sachs has approximately 3.54 times the proportion of data science professionals compared to the European Commission and about 2.44 times the proportion of machine learning professionals. However, the proportion of Technology professionals at Goldman Sachs is slightly lower (about 0.87 times) than at the European Commission, highlighting a greater relative concentration of technology skills within the Commission.

EU Cybersecurity Label Vote Rescheduled for May

A vote on a draft EU cybersecurity label that would have allowed Microsoft, Amazon, and Alphabet’s Google to compete for extremely sensitive EU cloud computing contracts has been postponed until May by national cybersecurity experts, according to people who know the situation on Tuesday. The experts, who met on Monday and Tuesday in Brussels, did not vote on the latest draft of the scheme proposed by the EU cybersecurity agency ENISA in 2020, tweaked by Belgium, which currently holds the rotating EU presidency, the people said.

The label was first proposed in 2020 by cybersecurity agency ENISA as a way to safeguard sensitive data once it is transferred beyond the EU's borders. Originally, the proposed label would require cloud service providers such as Google, Amazon, and Microsoft to embark on a joint venture with an EU-based company or build their own data center within the bloc’s borders so that EU data could be handled within the EU's borders.

The CRA imposes fines of up to €15 million or 2.5% of the total worldwide annual turnover for the preceding financial year, whichever is higher, for non-compliance with any essential cybersecurity requirements.

Breaches of other obligations could result in fines of up to €10 million or 2% of global turnover in the last financial year.

On 12 March 2024, the European Parliament approved the EU Cyber Resilience Act (“CRA”) with a large majority of 517-12 votes in favor of the legislation (with 78 abstentions).

Sunak Rejects Youth EU UK Mobility Scheme

The UK government has dismissed a Brussels proposal to allow young Brits easier access to study, work, and live in the European Union. Under the agreement proposed by the EU’s executive arm, young EU and UK citizens would have been eligible to stay up to four years in the destination country. Before Brexit, British nationals had the right to live and work freely in the EU, with reciprocity for EU nationals in the UK. Britain has shown interest in agreements with individual European nations and has its own Youth Mobility Scheme, which it has offered to some EU member states.

Currently, a young person from the EU seeking to study in the UK must pay £490, while a skilled worker visa costs between £719†and £1,639, the commission said.

Statistics from 2018 show that 32,000 EU nationals were funded to come to the UK, while an estimated 17,000 British students went to study in the rest of the continent.

Economics

Euro Area Unemployment At Record Low in February

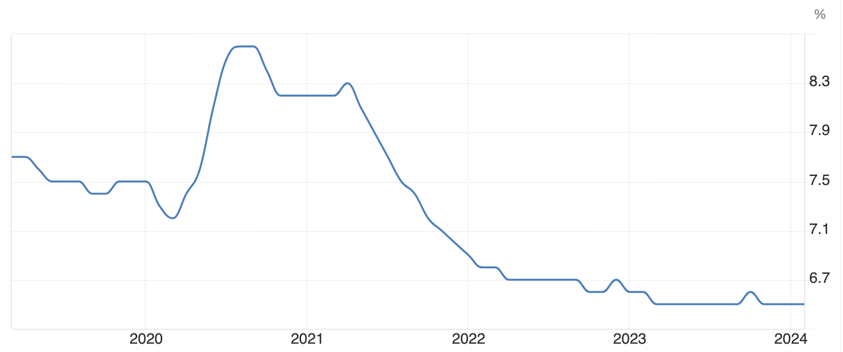

Eurozone Five-Year Unemployment Levels

The Euro Area unemployment rate remained at a record low of 6.5% in February 2024, unchanged from January's revised figure and slightly higher than market expectations of 6.4%. The number of unemployed people rose by 17,000 month-over-month to 11.102 million. Youth unemployment, which measures jobseekers under 25, stayed at 14.6% for the fourth month in February. Among the largest Euro Area economies, Spain had the highest unemployment rate at 11.5%, followed by Italy at 7.5% and France at 7.4%. In contrast, Germany posted the lowest jobless rate at 3.2%. Compared to a year ago, the overall Euro Area unemployment rate edged down from 6.6% in February 2023. In the broader EU-27, the unemployment rate was 6.0% in February 2024. The EU had an estimated 13.249 million unemployed individuals, while the Euro Area accounted for 11.102 million.

EU AI Investments On the Up

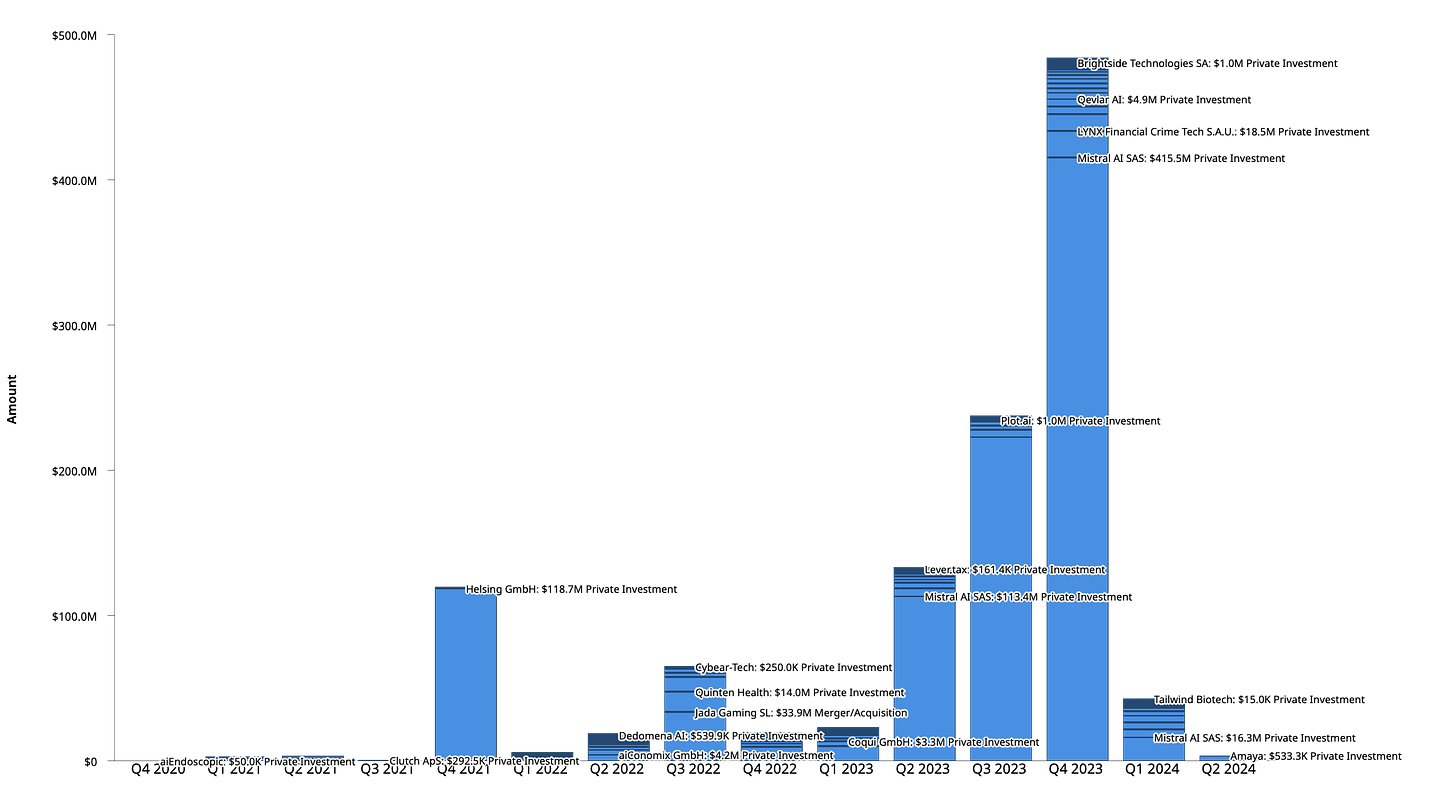

Investments in Generative AI and machine learning in the Euro Area increased significantly in Q4 of 2023, reaching their highest levels ever. This was largely due to Mistral AI's impressive $415M investment, more than the total amount invested in the previous five years combined. However, there was a sharp decline in investments in Q1 of 2024.

Investment Amount Over the Last Five Years - Euro area

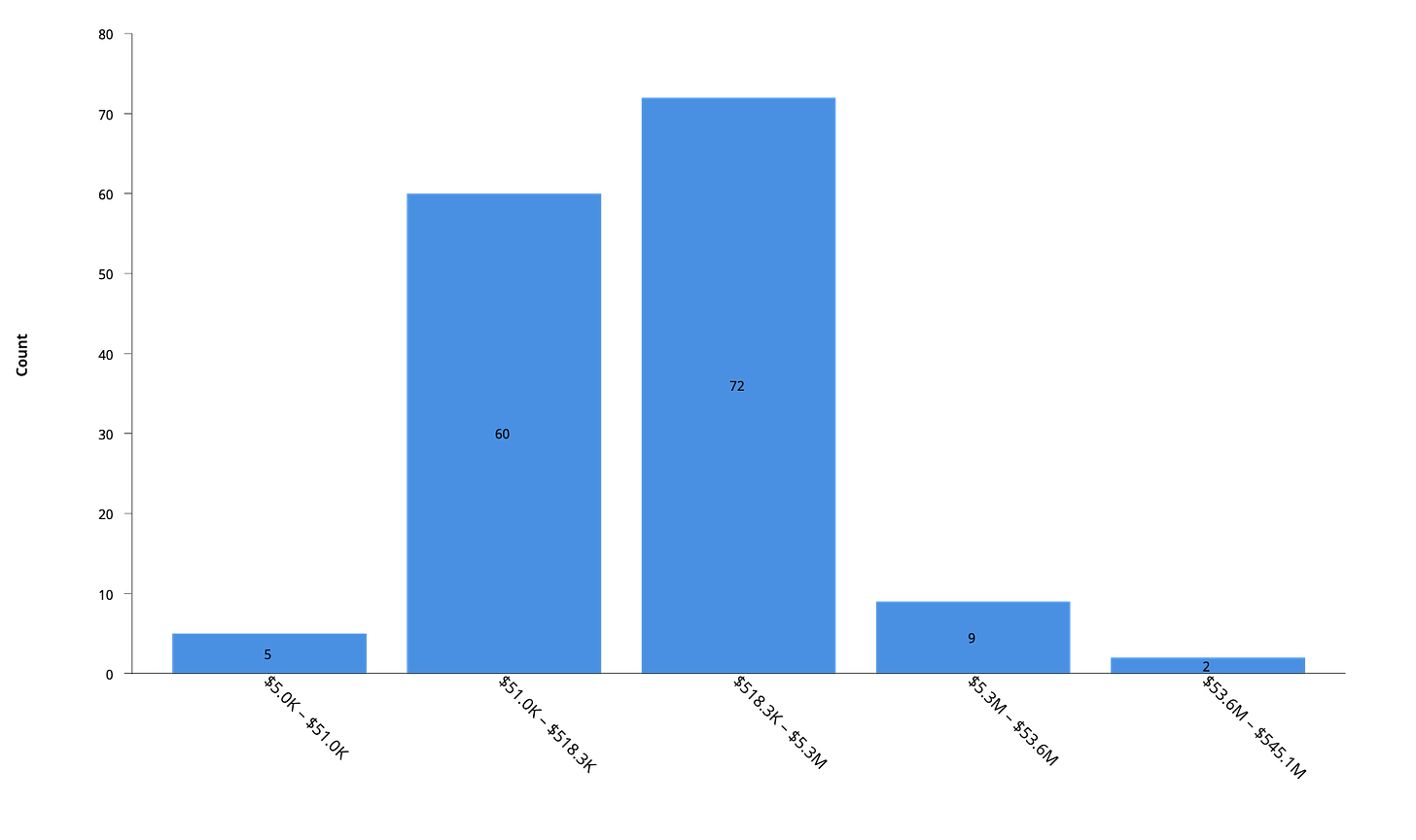

Most investments have been in the range of $500k to $5m. For comparison, the average investment in the same sectors in the USA is lower, ranging between $67k to $5.3m. However, the key difference is that within the EU, there are only 11 firms with more than $5.3m and two firms above $53m, whereas, in the US, there are 170 firms between $3.9m to $29m and 49 firms above $30m according to Crunchbase data.

Investment Amount Distribution - European AI Companies

Chinese Auto Sector Expands into Europe with Spain Plant Despite Growing Competition Concerns

Chinese carmaker Chery has signed a deal to produce mainly electric vehicles (EVs) in Spain, marking the second Chinese auto manufacturer to establish a presence in Europe after BYD announced plans to build a factory in Hungary in December. This expansion comes amid growing concerns from the European Commission about the subsidies China grants its electric vehicle sector, which Brussels argues distort competition and enable Chinese firms to offer "artificially low" prices.

In just 12 years, Chinese manufacturers have gone from accounting for a mere 0.1% of global EV sales to becoming a significant player in the market. The Dolphin Mini, a Chinese EV, costs just 69,800 yuan (approximately $10,000) in China, thanks to competition from other Chinese manufacturers. This competitive pricing has raised concerns in the UK, where the government is considering an investigation into whether Chinese-made EVs could potentially be used for espionage.

The UK and Europe have remained vigilant about the influx of Chinese-made EVs in recent months. In February, UK Transport Secretary Mark Harper warned that he would take action if China attempted to undercut competition in the UK market by making prices too low. The Kiel Institute, a German think tank that consults with China, reports that the Chinese government has granted subsidies worth at least $3.7 billion to BYD, which recently reported a 42 percent decrease in EV deliveries compared to the fourth quarter of 2023.

Chinese EVs tend to be cheaper than their Western counterparts, partly due to the fact that much of the manufacturing process involved in producing car batteries is carried out by Chinese companies. Additionally, the European Union levies a 10 percent tariff on all imported cars, which may further impact the competitiveness of Chinese EVs in the European market.

Rapid Growth of Chinese EVs in Europe

In 2023, Chinese manufacturers claimed 8.2% of the European electric car market, selling 86,000 battery electric cars, more than double their market share from 2 years ago.

China's overall share of the European car market surged from 0.1% in 2019 to 2.8% in the first seven months of 2023.

In the pure battery electric car segment, China's share rose from 0.5% in 2019 to 3.9% in 2021.

Price Advantage of Chinese EVs

Chinese EV makers have a significant price advantage, able to build an EV for about €10,000 less than European rivals.

The average retail price of an EV in China in 2023 was €31,165, compared to €66,864 in Europe - less than half the price.

Chinese brands are releasing competitive EV models that are at least $10,000 cheaper than European rivals.

Challenges for European Automakers

European carmakers could lose up to €7 billion of profit yearly to Chinese competitors as consumers seek cheaper EVs.

Major European automakers like Volkswagen are trailing Chinese brands in EV sales. VW has only a 3.7% share of electric car sales in China while facing growing competition from Chinese EVs in Europe.

European and US automakers are struggling with EV targets and profitability. Ford and GM reported big losses and cut production plans, while Mercedes and VW faced challenges.

As Chinese automakers continue to expand into Europe, it remains to be seen how the European Commission and individual countries will address the growing concerns surrounding subsidies, competition, and potential security risks associated with Chinese-made EVs.

That is all for this week’s EU Drip. Please get in touch with questions or thoughts.